WASHINGTON – U.S. rail traffic was down 4.8% in December, capping off a year in which volume fell 2.8% amid broad service problems on the big four U.S. railroads.

Total U.S. carload traffic for 2022 was 11,976,283 carloads, down 0.3%, or 34,001 carloads compared to 2021, according to the Association of American Railroads. U.S. railroads carried 13,452,480 intermodal units, down 4.9%, or 686,580 containers and trailers, from 2021.

Total combined U.S. traffic for 2022 was 25,428,763 carloads and intermodal units, a decrease of 2.8% compared to 2021.

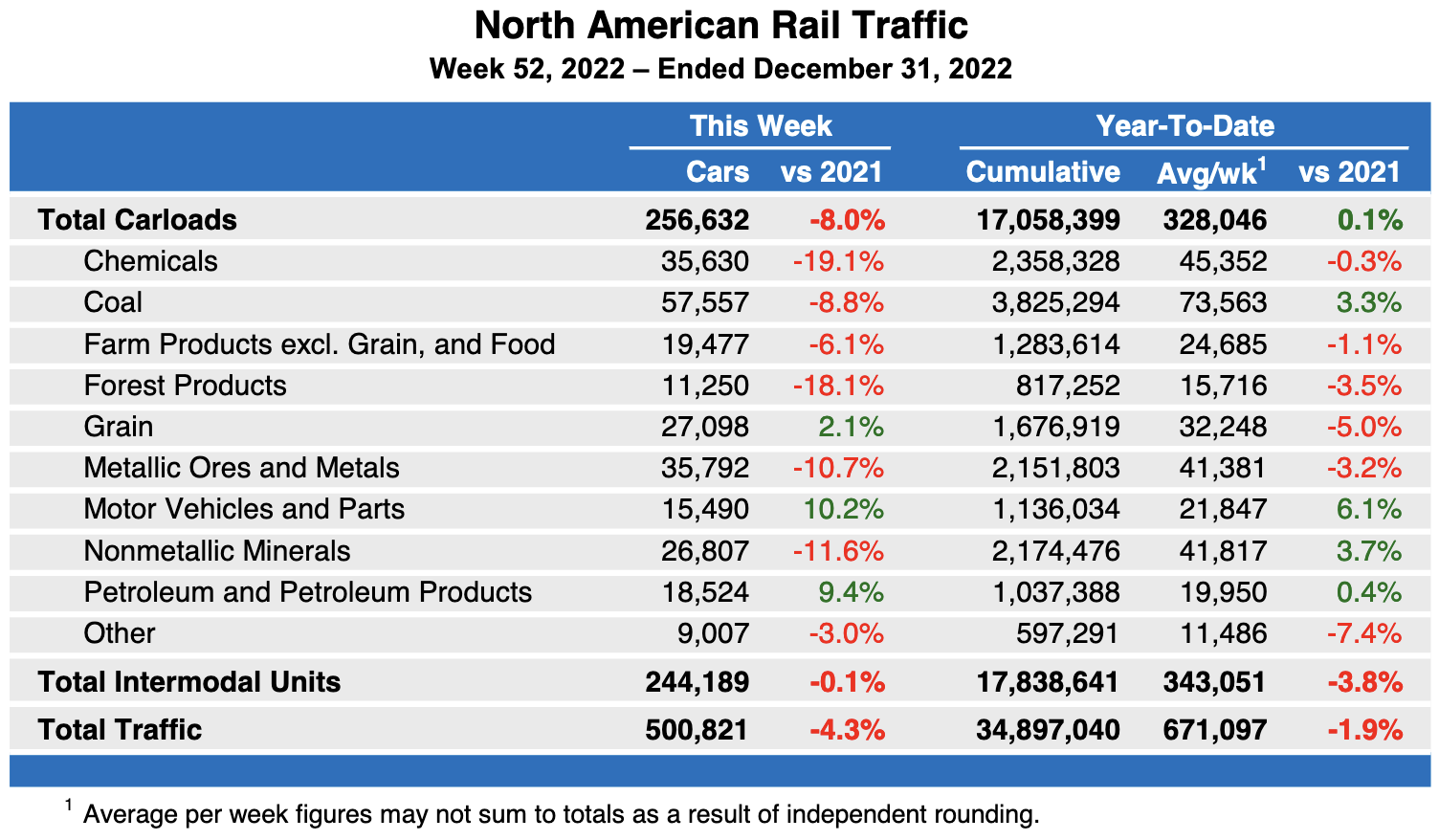

For the year North American rail volume slumped 1.9%, with Canadian traffic down 0.6% and Mexican volume up by 4.4%. Flat carload volume could not offset a 3.8% decline in North American intermodal volume.

U.S. railroads originated 842,171 carloads in December, down 4.4%, from December 2021. U.S. railroads also originated 900,213 containers and trailers in December 2022, down 5.2%. Combined U.S. carload and intermodal originations in December 2022 were 1,742,384, down 4.8%, from December 2021.

In December 2022, four of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with December 2021. These included: motor vehicles & parts, up 12.9%; crushed stone, sand & gravel, up 3%; and food products, up 3.2%. Commodities that saw declines in December 2022 from December 2021 included: chemicals, down 12.1%; coal, down 5.2%; and grain, down 5.2%.

“Rail markets are always evolving, and 2022 was no exception,” said AAR Senior Vice President John T. Gray. “Coal carloads grew solidly in 2022 largely because higher natural gas prices made coal-fired electricity generation more competitive. However, those same higher natural gas prices, along with other market disruptors, hurt rail chemical volumes, since natural gas is a key raw material for chemical manufacturing. Grain carloads in 2022 were slightly higher than the annual average over the past decade, but they were down year-over-year because 2021 was the best year for grain carloads since 2008. Intermodal volume in 2022 was the sixth best ever, but down from an even stronger 2021.”