WASHINGTON — Intermodal volume continued to be an issue for U.S. railroads in September, as container and trailer movement was down 6.7% over September 2020, leading to an overall traffic decline of 1.9% for the month despite a 4.3% increase in carload traffic.

“Rail intermodal volume is clearly not what it has been and could be,” Senior Vice President John T. Gray said in the Association of American Railroad’s summary of the month’s traffic. “Keeping intermodal terminals functioning smoothly and at full capacity depends on consistent freight outflows to make room for new freight inflows. Unfortunately, due to limited availability of downstream truck and warehouse capacity, that’s not happening right now with predictable impacts on rail intermodal volume. There is no single solution to this problem but railroads are bringing intermodal yard capacity back online to increase storage availability as well as working with customers and truckers to accelerate container pickup among other efforts.”

Carload traffic included a 13.7% increase in coal and a 12.5% increase in crushed stone, stand, and gravel; motor vehicles and parts were down 27.6%, reflecting manufacturing issues resulting from continuing computer-chip shortages.

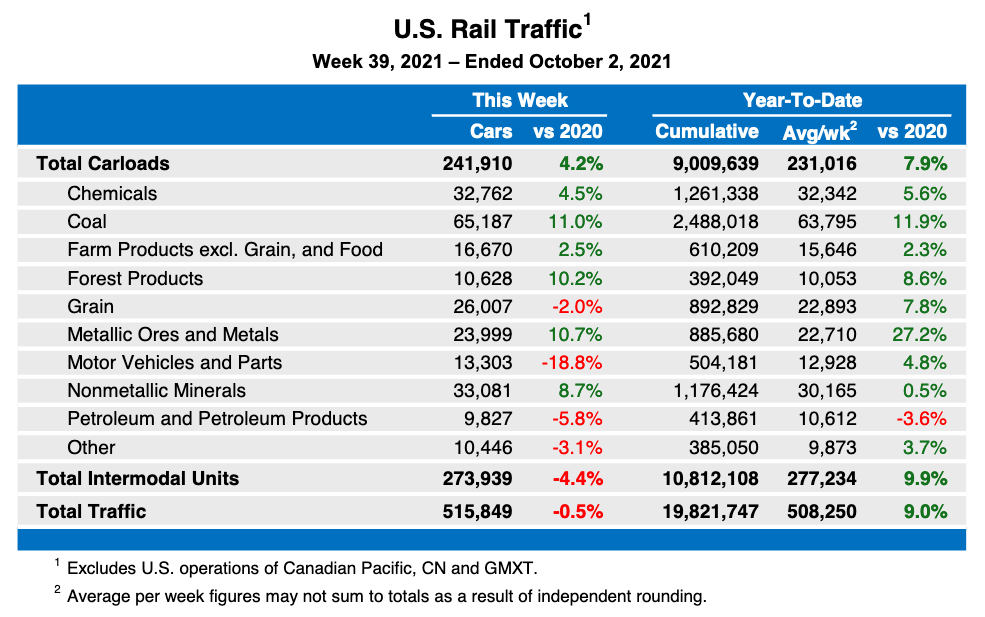

Year-to-date traffic remains well ahead of 2020 volume, with carloads up 7.9% and intermodal units up by 9.9% for a total increase of 9% through the first nine months of 2021.

Weekly traffic also shows intermodal drop

U.S. traffic for the week ending Oct. 2 totaled 515,849 carloads and intermodal units, a 0.5% drop compared to the corresponding week in 2020. That included 241,910 carloads, up 4.2%, and 273,939 intermodal units, down 4.4%.

North American totals for the week on 12 reporting U.S., Canadian, and Mexican railroads, include 340,442 carloads, up 2.9%, and 356,688 intermodal units, down 6.3%. The total volume of 697,130 carloads and intermodal units represented a 2% decline over the same week in 2020.

The real reason intermodal is down, is because of the excessive long trains that can’t get out of the terminal and there is no room to get into the final terminal not to mention the the long schedules that are a result of saving money via PSR.

I don’t believe that is totally correct, might be an issue on running the trains and handling but far from the only problem. You got a huge problem on terminal end and the roadways. A lot of issues with enough trucks and chasis to move containers out of destination terminals and just as much issues on the warehouse end.

..

Corporate America needs to be honest in the fact that they drive down costs across board assuming everything outside of the office/financial world has to be cheap & third party and one more place is a blue collar job of driving truck is somehow not a trade, skill, craft or an art since it doesn’t require a college degree. However the whole logistics chain involving containers also requires the last mile out of a terminal. And here we are…

..

No one who is following the Cali pipeline spill shouldn’t be surprised that Big Oil has divested most of the country’s pipeline ownership to 3rd party low cost operator hoping to squeeze out a profit. So when the pressure gauge drops and a problem evident the first thing to do is keep things flowing because you might take a hit on a low margin operation.

I’m not so sure about the issues on the destination warehouse end. In a number of markets, the stuff that is delivered to the warehouses is quickly sent to the final location be it a manufacturer or a sales location.