WASHINGTON — Federal regulators are summoning executives from the six Class I freight railroads to a rare public hearing to explain how their companies plan to invest in and grow their business amid concern over recent negative volume trends.

In a notice published today (Friday, July 12), the Surface Transportation Board said it also welcomes railroad customers, suppliers, and rail labor to testify during the two-day hearing on Sept. 16 and 17 at STB headquarters in Washington, D.C.

“The board has an interest in the health and growth of the industry and the need for rail customers to move their goods efficiently and reliably,” the notice states.

“While the board recognizes that some shifts in volume may not be primarily within the control of rail carriers, the board has observed that over the past 10 years carload volumes have not grown, and have in fact decreased.”

To back its assertion, the STB pointed to a recent report published by the Federal Reserve of St. Louis showing railroad carload traffic declining 28% from May 2014 to May 2024.

“The board wishes to explore how industry participants are strategizing and innovating to reverse this recent trend and achieve freight rail growth … as well as the challenges and effects associated with a failure to grow.”

Those participants, according to the notice, include representatives from BNSF, Canadian National, Canadian Pacific Kansas City, CSX Transportation, Norfolk Southern, and Union Pacific.

The STB is asking the railroads to reveal plans for short-, medium-, and long-term growth, including investment details by traffic type, and is encouraging short lines to provide growth plans as well.

“The board is also interested in shippers’ plans or desire for future use of rail, factors that may affect their shipment decisions, and what rail carriers are doing and can do to increase shippers’ use of rail,” according to the notice.

Short-term outlook unsteady

Stagnant consumer demand could keep a lid on rail volume growth in the short-term.

In its most recent monthly economic outlook, the Association of American Railroads noted that the Index of Consumer Confidence three-month average as of June is the lowest in almost two years, “driven by worries over high food and gas prices, political instability and global conflicts. It remains to be seen how consumer spending will evolve in the coming months.”

Asked to comment on the STB’s upcoming hearing, AAR Assistant Vice President of Communications Jessica Kahanek told FreightWaves, “Every railroad continues to take meaningful actions to position their company for growth.

“As seen in recent announcements, railroads are investing to grow the business and help rail-served businesses compete into the future, such as launching new partnerships across the supply chain and key traffic lanes or developing industrial sites to help attract new customers.”

Politics at play?

Michael McBride, a partner with the law firm Van Ness Feldman who has practiced for 48 years before the STB and its predecessor, the Interstate Commerce Commission, said he cannot remember federal regulators holding a hearing specifically to talk about rail volumes and investment strategies.

“They are required to regulate railroads to ensure they’re healthy and earning adequate revenues, and they’ve had hearings in recent years on service issues or when there has been a particular crisis, but a special hearing on future growth and investment is a bit unprecedented,” McBride told FreightWaves.

The hearing is also a way for STB Chairman Robert Primus, who took the reins of the agency in May, to “carve out a role for himself like any new agency head that serves at the pleasure of the President,” McBride said.

Primus, who has served on the STB board since January 2021, has been one of the more critical board members with regard to railroad conduct recently, McBride noted, in how railroads have dealt with customers and treated their employees.

“Holding this hearing is good policy and good politics,” McBride said. “[Primus] wants these guys to commit to getting their business growing again, and it also fits with the Biden administration’ s attitude that putting traffic on the railroads and getting it off the highway is a way to reduce pollution and greenhouse gas emissions. Music to the administration’s ears.”

— This article originally appeared on the website FreightWaves, a sister property of Trains.com owner Firecrown Media.

This is a moot point.

The Class I’s have no plans for growth.

They do have infinite plans to shrink, however.

How much of the decline in carload traffic is the decline in coal traffic? What does that leave the rest of carload traffic? What is the market share in key markets and how has that changed?

as long as wall st is running the railroads. nothing good will ever happen.

How much of that carload traffic moved to intermodal thereby staying on the rails?

Sadly, intermodal took the biggest hit with PSR, the class 1 I work actually closed intermodal yards and cut back on many service lanes.

Incredibly stupid actions. Assuming intermodal is now the largest railroad market segment the number one problem/obstacle for most of the past 12 months is what appears to be excess capacity/supply in the truckload industry. Truckload rates have stayed consistently low for a much longer time frame than most observers expected. I do hope the mental midgets at the STB are not expecting railroads to get into a pricing war with the truckers.

I think the STB wants to see how the railroads will invest their profits. Stock buybacks, capital investment in infrastructure, human resource retention, etc.

Some my ask why would the STB/USG care, since it is a private company?

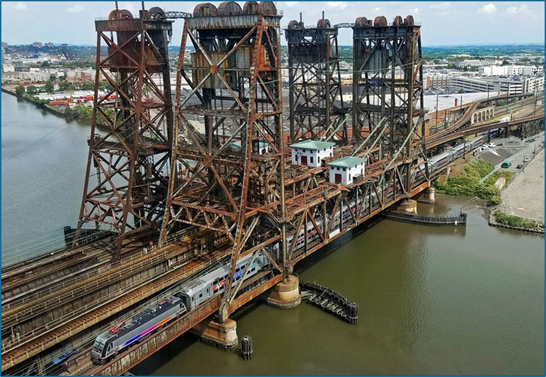

Have you seen the amount of federal grants that have gone out to replace/repair/restore old rail bridges and ROW’s in the past 20-30 years? That capital provided by the tax payer in essence subsidizes and allows the redirection of earned revenue to stock buybacks and oversized executive bonuses.

So yes, I do think its appropriate to have the STB start asking about where the money is going. Something that former STB Chair Oberman starting asking questions about to Ancora, and now Primus will follow up.