WASHINGTON – Surface Transportation Board members appear skeptical about CSX Transportation’s bid to force its way on to the Kansas City Southern-Norfolk Southern Meridian Speedway.

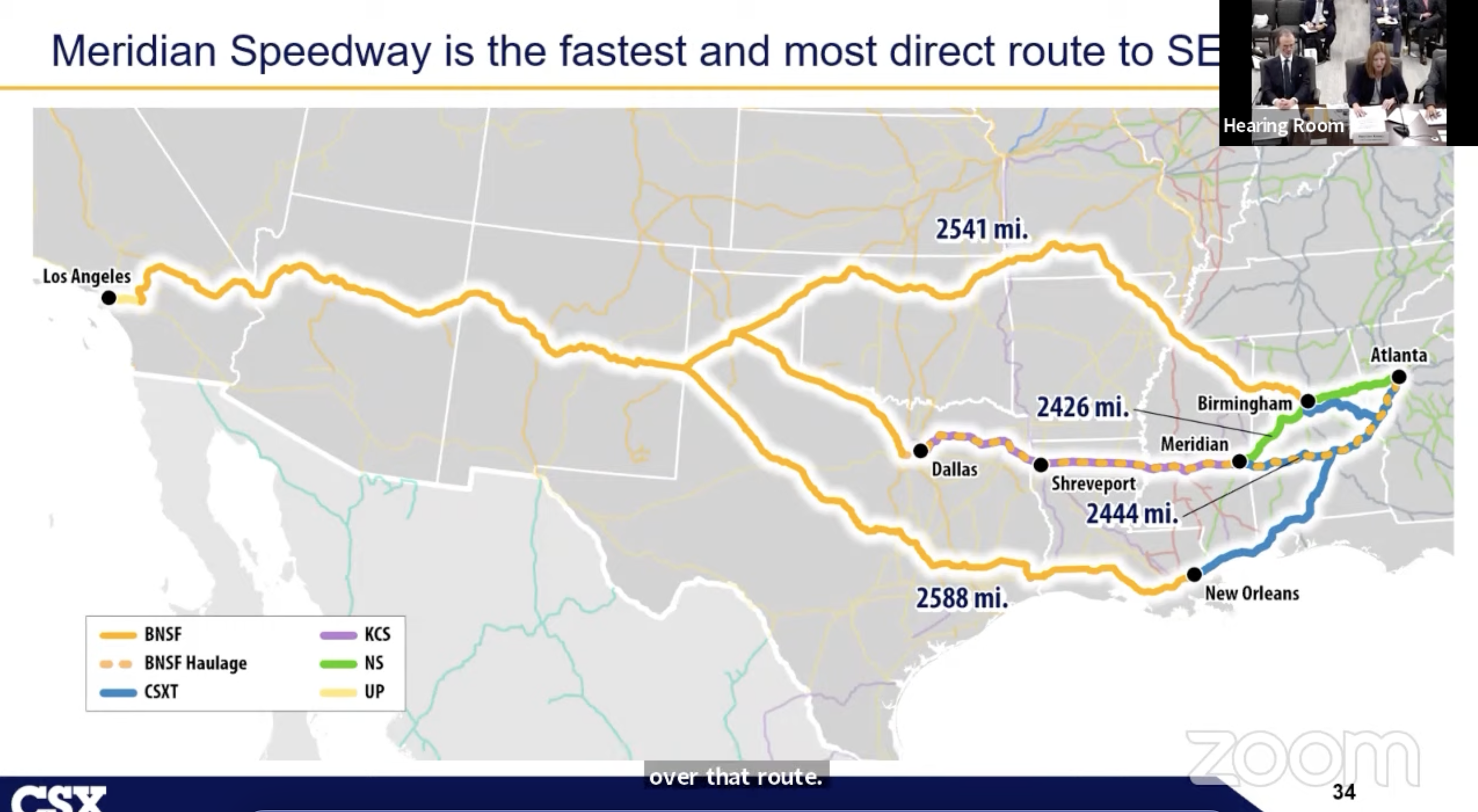

The Meridian Speedway — which runs from Meridian, Miss., to Shreveport, La., — is the shortest, fastest route between the Southeast and Southwest.

NS and KCS formed the Meridian Speedway joint venture in 2006, with NS gaining a 30% interest in the KCS route in exchange for investing $300 million in capital improvements. As part of the joint venture, NS got the exclusive right to interchange intermodal traffic with KCS at Meridian.

The Meridian Speedway was not controversial until the proposed Canadian Pacific-Kansas City Southern merger came along. Now CSX wants in. NS wants to keep CSX out. And NS wants to protect the route that carries nearly 10% of its intermodal traffic, saying CPKC might pose a threat to reliable service.

The STB tried to sort all this out last week during the second and third days of CP-KCS merger hearings.

CSX sees unlawful barrier to competition

CSX contends that KCS and NS have unlawfully blocked other railroads from interchanging intermodal traffic on the Meridian Speedway, and that the CP-KCS merger will only exacerbate what it views as a harm to competition.

CSX says it was close to reaching a deal with KCS and BNSF to launch service between the Southeast and Fort Worth when NS and KCS announced their Meridian Speedway agreement. CSX doesn’t reach Meridian directly, but can reach it through Genesee & Wyoming short line Meridian & Bigbee via Montgomery, Ala.

NS feared competition on the route and sought to freeze out CSX through the Meridian Speedway joint venture, CSX counsel Paul Cunningham argued before the board. The intermodal interchange exclusivity portion of the agreement is unlawful, he says, and should have been subject to STB review at the time. Instead, the joint venture was allowed to proceed as the type of deal that is exempt from board review.

“The board has the authority to put the genie back in the bottle” as part of its review of the CP-KCS merger, Cunningham told the board.

STB Chairman Martin J. Oberman said he had a hard time believing that CSX didn’t try to top NS with a $301 million bid to gain access to the Meridian Speedway and that after being shut out it sat on its hands for 16 years.

CSX was unaware of how the deal was structured and that it should have been considered an illegal barrier to competition, Cunningham said, until he was asked to look into it when CP and KCS sought to merge last year.

“That’s a fairly strong claim to sit on for 16 years,” Oberman said.

“It’s not a claim that was known,” Cunningham said.

But board member Patrick Fuchs said CSX cited the Meridian Speedway exclusivity agreement in filings with the board regarding its 2015 joint infrastructure improvement plan with short line Louisville & Indiana. As part of that deal, CSX gained a permanent easement — with exclusivity provisions to protect its $100 million investment — to operate over the L&I between Louisville, Ky., and Indianapolis.

“I’m not getting into the broader public interest … I’m only addressing the contention that CSX was in the dark for all these years and didn’t look at it when it seems as though you’re actively citing the exemption, you’re drawing from the contracts to inform your own joint use agreements,” Fuchs said.

After a question from board member Karen Hedlund, CSX was unable to cite a precedent in which the board unwound a similar agreement.

But Cunningham said if something was illegal 16 years ago, it’s illegal today, and emphasized CSX only wanted to strip the intermodal exclusivity provision from the Meridian Speedway agreements so it could compete with NS. CSX would be willing to invest in the corridor if that was required.

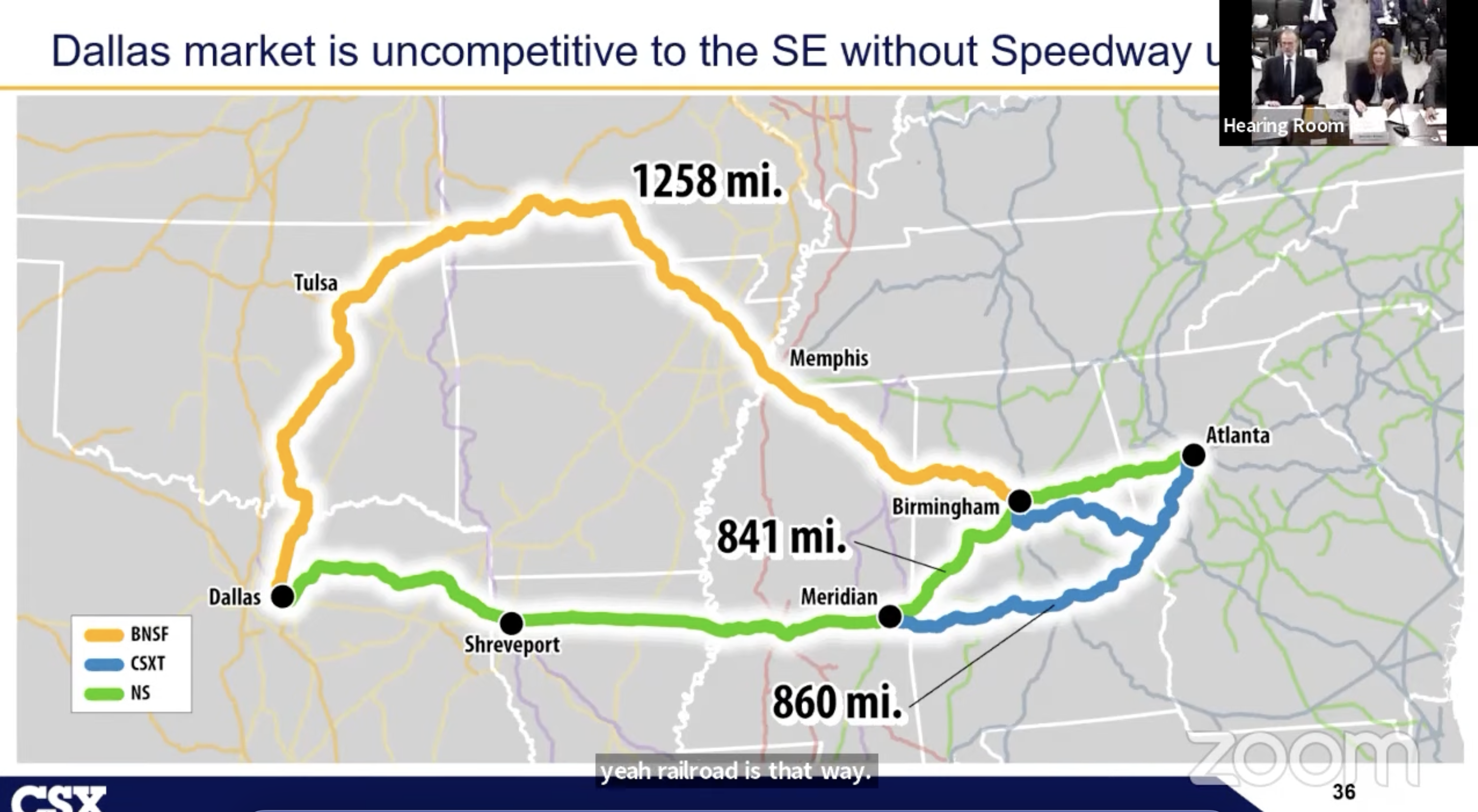

Maryclare Kenney, CSX’s vice president of intermodal services, says BNSF’s transcontinental traffic takes a roundabout route that’s not competitive with the Meridian Speedway. These trains also bypass the Dallas/Fort Worth area, leaving CSX with no efficient way to serve the key Atlanta-Texas market. CSX’s alternative routes — via New Orleans or Memphis — are significantly longer and slower than the Meridian Speedway’s straight shot from Meridian to the Dallas area, she notes.

“They didn’t just lock the door to competition,” Kenney says of KCS and NS. “They threw away the key forever.”

Competition is alive and well, NS says

Michael McClellan, Norfolk Southern’s senior vice president and chief strategy officer, told the STB that intermodal competition to and from the Southeast is alive and well. The Meridian Speedway lost half of its intermodal traffic when BNSF shifted its Atlanta business to CSX via Birmingham, Ala., in 2007, McClellan told the board.

McClellan said CSX made “absurd claims” about the Meridian Speedway agreement, either ignores or fails to understand the document that runs hundreds of pages, or cherry-picks portions of the agreement to make misleading and invalid points.

NS and KCS operated interline intermodal service in the early 2000s between Dallas and Atlanta, McClellan says, but service deteriorated along with the KCS main. KCS couldn’t fund improvements on its own, McClellan says, and the joint venture allowed NS to beef up the main and expand capacity.

Now NS is concerned that service might suffer due to a combination of factors: Projected CPKC growth at the Wylie intermodal terminal outside Dallas, increased traffic and operational changes between Wylie and Shreveport, and CP’s dismissal from the joint Union Pacific-NS EMP domestic container pool.

“That creates a real problem for us because a significant amount of our business moving between Dallas and Atlanta moves in the EMP program,” McClellan says. “The KCS has access to the EMP program, the CP doesn’t, and at this point we don’t have a replacement program for that box program and the significant number of customers that are using it.”

UP and NS exchange intermodal trains at the west end of the Speedway at Shreveport.

KCS will be unable to take CP’s place if the merger is approved. UP has the right to determine what western railroads can participate in the program, McClellan says.

A warning for Union Pacific

Oberman later asked UP how dropping CP from the EMP pool was pro-competitive.

“The original intent of the EMP box program that’s a joint venture between the UP and the NS was to drive business to the railroads and interline business,” said Michael Rosenthal, counsel for UP. “Obviously with the specter of the merger and things like that, the competitive nature of those things have changed quite a bit, and so there was a decision made commercially to make a change to that.”

UP would reconsider its decision if the STB denied the CP-KCS merger application, he said.

“Well, my reaction is that it was punitive, a retaliation for the merger,” Oberman said. “I can’t interpret it any other way.”

He added: “All things considered, quite frankly, it doesn’t put UP in a particularly good light when we’re considering protecting UP’s competition. A word to the wise, for what it’s worth.”

NS seeks conditional trackage rights between Shreveport and Wylie, in place of current haulage rights, in the event that service deteriorates under CPKC.

Fuchs asked why NS is seeking protections for intermodal traffic when for years it has said that the competitive traffic didn’t need any sort of regulatory backstop. Intermodal is not a commodity that the STB regulates.

NS Chief Marketing Officer Ed Elkins said service protections were necessary to avoid traffic diverting to the highway in the event that service falters once CP and KCS combine.

CP and KCS are scheduled to rebut merger comments on Thursday, the last day of public hearings regarding their proposed $31 billion merger, the first among Class I’s in two decades.

CSX Bitching and crying because they aren’t competitive in an important market, West Coast to south east. NS saw the light, but hasn’t wised up to the fact that they need improvements on their portion (Atlanta-Birmingham-Tuscaloosa) portion of the route also.

NS & UP are tied to the Meridian Speedway. UP saw that they could make more money short hauling themselves to Shreveport thru Speedway to Atlanta.

BNSF meanwhile still wants to long haul it and get every dime it can, even thought it’s longer and not as competitive as UP-KCS-NS routing. They could be as competitive time wise if they handed it off to KCS at Dallas then thru Shreveport to Atlanta. CSX still would be left out.

Then again, if the old AT&SF would have seen the light, I should have acquired the Rock’s Choctaw route to Memphis in 1980/81. This route would have offered competition to the Speedway. It would have been only about 85 miles longer than the Speedway, and BN would have had ALL the revenue to Birmingham. Then they could hand it over to either NS or CSX or could have trucked it to Atlanta. Even this way CSX would have been shorted.

The Meridian & Bigbee (former Louisville & Nashville tracks, BTW) will need massive amounts of upgrading if CSX wants to run Intermodal over it, maybe even replacing the fabled bridge over the Tombigbee River @ Pennington, AL.

I don’t think Georgia-Pacific @ Pennington would like CSX Intermodals running through their back yard/train yard, either; I could foresee a bypass being built around the G-P plant.

I doubt the little towns along the line have any clue what could be coming down the track so to speak, they’ll be running to the state for infrastructure relief. Plus I could foresee the City of Selma asking for a King’s Ransom before CSX ran Intermodals through.

The only portion of the M&B that is ex-L&N is the track from Myrtlewood to Selma.

The line from Meridian, MS to Myrtlewood, AL is the original 1926 charter of the Meridian & Bigbee River Railroad. Which was reorganized in 1942 as today’s M&B Railroad under G&W ownership.

In the Bible Jesus talks about before criticizing your brother about about the wooden splinter in his eye, take out the big wooden beam in your own eyes.

All of the class ones leave a lot to be desired. Rather than worry about their competitors flaws, all need to get their own house in order. Especially CN

Man, those are some sour grapes espoused via some big time hired guns of the Kitty.

IMO NS’ problem with the Speedway comes to one item. Lack of invessting in the route. Spent a long time looking at the route KCS to Atlanta. The number of total sidings on the route is not adquate.

Don’t know about the KCS portion but the NS route needs about 4 – 6 more sidings. Also more crew. ( admit that it is system wide however NS has not indicated such ). An example there is the stack up of traffic to NS in Meridian> Amtrak tracker has shown too many times #20 zero speed for 1/2 hour or more. Once was over an hour.

I will admit for about last month and 1/2 running times much better with exception into TCL, both 19 and 20 consxiently arrive late into TCL. Part of that the enroute schedule for both trains out of TCL is much greater than into MEI. Have seen #20 gain over 1 hour TCL – BHM.

example #20 knocked off 62 minutes MEI – BHM today. Scheduled for 2:01.

Too funny.

-CSX making noise because they don’t have track where the business is. Whose fault is that? Besides even if you had the track, you don’t have the crews to staff them. Hidden blessing?

– Right to call out CSX for the bellyache over exclusive Meridian, when they have one themselves from Indy to Louisville. CSX talk with forked tongue.

– Marty Oberman calling out UP for kicking CP out of EMP, punitive? Yes!

Can’t it just be a joint KCS(eventually CPKC)-NS-CSX line? Or does reality not work that way?

No, reality and contracts do not work that way…the Speedway was created via a contract, contracts are binding and CSX doesn’t like some of that binding language(even though they then used it themselves for another corridor).

1. So is CSX saying that its okay with Open Access? NS bought 30% ownership in the line so should get to help dictate who runs on the line. This coming from a CSX shareholder.

2. Not that NS is being terribly consistent either in asking for protection, but at least has ownership in the line– though the EMP issue is a concern for all. But intermodal is not regulated by STB. Another example like the above of the railroads wanting their cake and eat it too!

I am experience railroad whine overload. I’m tuning out the whine details, which railroad is whining about whatever they’re whining about. While the shippers can’t get service and the T+E crews get the shaft.