WASHINGTON — U.S. rail traffic was down again for the month of February, showing a 5.2% decline compared to figures for the same month in 2022.

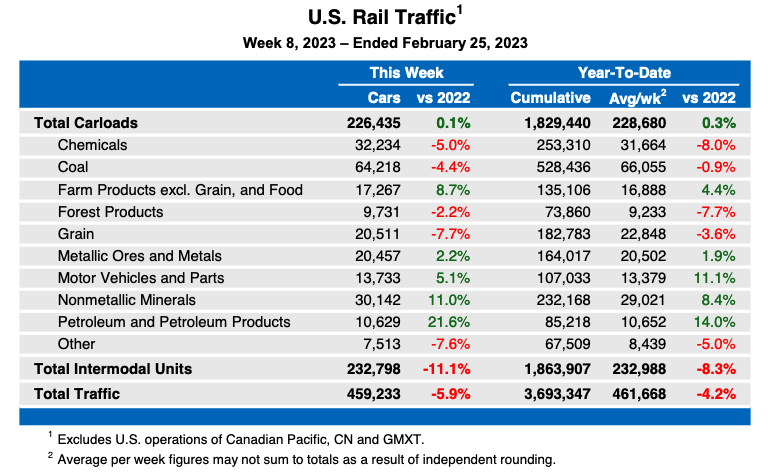

The overall drop included a 1.6% decrease in carload traffic and an 8.4% decline for intermodal volume, according to the Association of American Railroads. It followed a 3.2% drop in January, compared to January 2022.

“Coal, chemicals, and grain together account for more than half of all non-intermodal U.S. rail volume. When all three are down, like they were in February, it’s very hard for total carloads not to be down too,” AAR Senior Vice President John T. Gray said in a press release. “On the positive side, several commodities including crushed stone and sand, petroleum products, steel products, grain mill and food products showed very strong performances.”

Through two months of 2023, carload traffic is up 0.3% while intermodal trailers and containers are down 8.3%, leading to an overall decline of 8.4%.

Weekly traffic also down

Traffic for the week ending Feb. 25 was also down from 2022 levels, continuing a streak that has seen volume decline from year-earlier figures for every week so far this year. The week saw 226,435 carloads, up 0.1% from the corresponding week in 2022, along with 232,798 containers and trailers, down 11.1%.

The week’s North American volume, for 12 reporting U.S., Canadian, and Mexican railroads, included 327,221 carloads, up 2.9% from the same week in 2022, and 308,029 intermodal units, down 9.3%. Total traffic was 635,250 carloads and intermodal units, down 3.4%. Year-to-date North American figures are down 2.3% through eight weeks.

I think it is interesting the last few years and even before the pandemic, intermodal traffic has done worse than traditional car load traffic. I think precision railroading really helped to kill market share, with its poor service. I think two things to do that could help class ones is to run shorter but more frequent intermodal trains and work with the short lines to keep adding new car load business, which most short lines are very good at. The short lines maybe could help the class ones get more business regionally and locally. Since someone sitting in an office Jacksonville or Omaha has very little knowledge of potential new business in the thousands of small towns their lines run through.

A recession is coming.