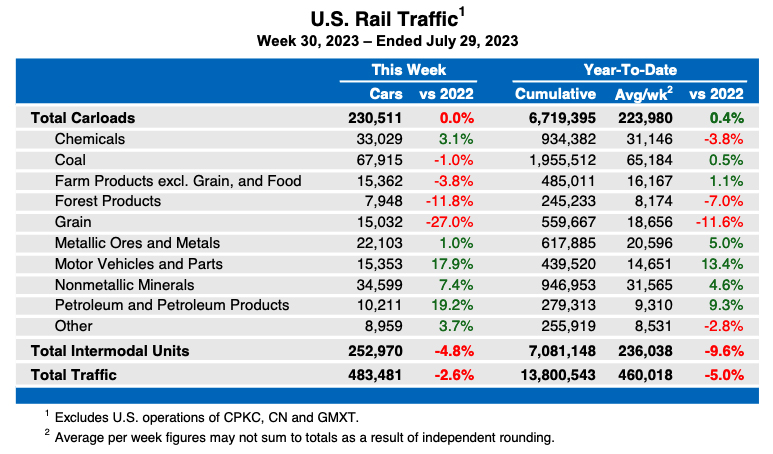

WASHINGTON — U.S. rail traffic remained below 2022 levels in July, but statistics from the Association of American Railroads provided mixed messages about traffic trends.

Meanwhile, traffic for the week ending July 29 continued the recent trend of lesser declines than had been the case for much of the year, with overall traffic down 2.6% compared to the same week a year earlier. It was the fifth time in six weeks the decline has been 3.2% or less.

For the whole of July, overall traffic was down 3.3%. That followed a decline of 3.9% in June and nearly equals the smallest drop of the year, a 3.2% decline in January. The overall figure includes a 0.6% drop in carload traffic and 5.5% decline in intermodal volume.

“As the economy goes so goes rail traffic, and we’re seeing that with the mixed results across volumes being affected by larger varying market conditions,” AAR Senior Vice President John T. Gray said in a press release. “The three non-July 4 weeks in July were the three highest volume intermodal weeks of the year, and carloads of chemicals rose in July for the first time in almost a year. At the same time, July was exceptionally weak for grain carloadings. July rail volumes are always affected by Independence Day closures, so we are cautious to put too much stock in this month’s results, but there are reasons for both optimism and caution.”

Overall U.S. traffic, through 30 weeks of 2023, is down 5% from the same period in 2022. That includes a 0.4% increase in carload traffic and a 9.6% drop in intermodal volume.

Week of July 29

Total volume for the week was 483,481 carloads and intermodal units. That includes 230,511 carloads, level with 2022 levels, and 252,970 containers and trailers, down 4.8%.

The week’s North American volume, for 10 reporting U.S., Canadian, and Mexican railroads, includes 336,501 carloads, up 0.8% compared to the same week in 2022; 333.238 intermodal unites, down 7.3%; and a total volume of 669,739 carloads and intermodal units, down 3.4%.

For the year to date, North American traffic is down 4.1% compared to the first 30 weeks of 2022.