OMAHA, Neb. – The intermodal terminal Union Pacific is set to open in California’s Inland Empire will start small, but railroad officials call it a game changer that could lead to signficant growth.

The terminal planned for West Colton yard will have capacity for just 45,000 lifts annually when it opens in a month or so, executives said at the railroad’s investor day on Tuesday. But UP says expansion projects could one day allow the terminal to capture more of the area’s 1.5 million loads per year.

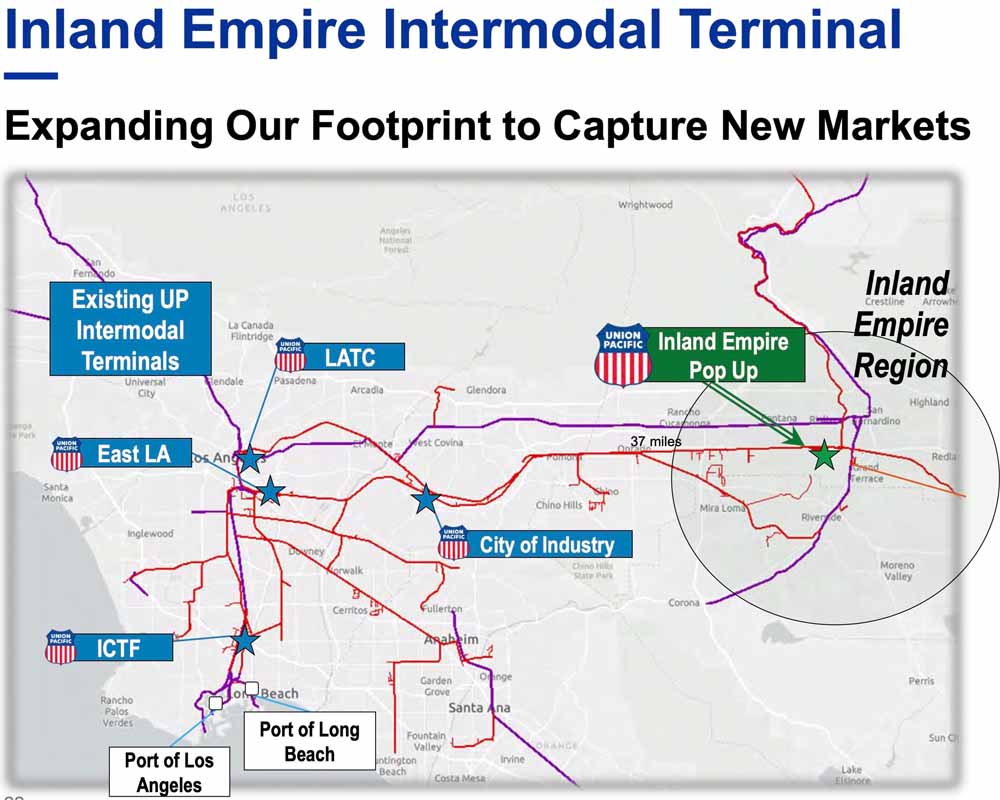

Containerized imports are trucked from the ports of Los Angeles and Long Beach to Inland Empire warehouses for transloading into domestic containers before being shipped to inland destinations. Roughly half of the ports’ volume bound for inland markets – such as Chicago, Dallas/Fort Worth, and Memphis – is transloaded.

“Our new Inland Empire intermodal terminal creates a tremendous opportunity to position Union Pacific directly in the heart of this massive import distribution region,” says Kari Kirchoefer, the railroad’s vice president of marketing and sales for premium traffic. “The plan is to expand our intermodal presence into our West Colton yard, which will allow us to reduce dray costs, create new solutions for our customers, and compete effectively for domestic freight.”

Service will launch between West Colton and Chicago and will be expanded to include Dallas and destinations in the Southeast.

The West Colton terminal is within 10 miles of most of the 625 million square feet of industrial warehouse space in the Inland Empire. UP’s nearest terminal in the Los Angeles basin, at City of Industry, is 37 miles away.

“Conservatively, we estimate the Inland Empire market size to be around 1.5 million intermodal units annually,” Kirchoefer says.

“I think it makes complete sense,” says intermodal analyst Larry Gross. “They’re not really participating in the transload market very well because you have to backtrack. Today they have to pick it up at City of Industry.”

BNSF Railway already serves the Inland Empire through its large terminal at San Bernardino, which is just a few miles from UP’s West Colton yard. “This is competition for BNSF,” Gross says.

BNSF’s San Bernardino terminal handled just over 604,000 lifts in 2015, more than double the 272,000 lifts at UP’s City of Industry terminal, according to a 2017 report by Robert Leachman of the University of California, Berkeley.

With San Bernardino operating at capacity, BNSF in 2019 opened a $27 million intermodal terminal Barstow, Calif., to provide domestic container service to and from Chicago.

For more than a year UP officials have been discussing the potential for rationalizing the railroad’s intermodal terminals in the Los Angeles area, like it has done in Chicago.

“We are continually reviewing our network for improvements that lead to operating a safe, reliable, and efficient service for our customers. Intermodal facilities throughout our network will continue to be part of that process, but our expansion into the Inland Empire in Southern California is separate from these reviews,” says UP spokeswoman Robynn Tysver. “Our new Inland Empire Intermodal Terminal demonstrates our commitment to intermodal and the strength of Union Pacific’s franchise to grow quickly and strategically using our existing footprint.”

UP has announced several intermodal expansion projects recently. Among them: Its first terminal in the Twin Cities of Minnesota, which opened in January for domestic service to and from Southern California. This summer the railroad will open a terminal in Pocatello, Idaho, to handle containerized exports of hay and other agricultural commodities. And by year end UP will open a grain transload facility at its Global 4 intermodal terminal in Joliet, Ill., allowing customers to fill international containers for export.

“We believe intermodal is a growth engine for UP,” says Kenny Rocker, the railroad’s executive vice president of marketing and sales.

“I’m encouraged to see Union Pacific is interested in growing the business,” Gross says. “Putting new dots on the map is a critical thing to help intermodal penetrate more markets.”

— Corrected on July 28, 2021, to remove incorrect reference to eventual size of new UP terminal.

The place is going to be a bust. It’s too small…come on. Show boating, with BNSF for crumbs. Santa Fe, kicks butt

And why transload at all? Wasn’t McClean’s original idea behind containerized freight to eliminate duplicate handling of material? Why not just ship the 40 ft units all the way from the far east to the east coast?

Again…the failure to figure out a way to eliminate the trucking portion from the ports to the intermodal terminals themselves is the problem here. Even running shuttles back and forth, any idea to take all those trucks off the roads would improve both traffic and pollution.

Amen, brother Amen. It seems like they should load the international containers on railcars at the ports to haul them to the Inland terminal if it’s necessary to transload them to domestic containers. Don’t the ports have the capability to do this at the same or less cost than putting them on a trailer? Why would the EPA allow them to generate unnecessary pollution by all those trucks when rail would be much cleaner?