WASHINGTON — The latest weekly U.S. rail traffic figures show a massive increase over the same week last year — a reflection of a week in 2021 when rail traffic experienced massive weather disruptions.

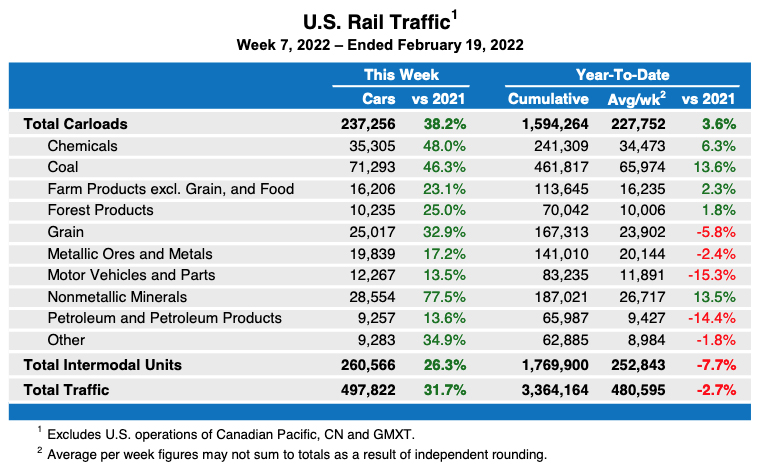

Statistics from the Association of American Railroads show U.S. railroads handled 497,822 carloads and intermodal units for the week ending Feb. 19, a 31.7% increase over the corresponding week in 2021. The 260,566 intermodal units represent a 26.3% increase; the 237,256 carloads mark a 38.2% increase. All 10 categories of carload commodities showed increases ranking from 13.5 percent to 77.5%.

Those figures are compared to a week in 2021 when overall traffic fell 21.7% from the same week in 2020 as weather disrupted rail movements from coast to coast. In that week, every carload commodity showed a decline [see “Weather woes lead to steep decline …,” Trains News Wire, Feb. 25, 2021].

Better measures of the week’s rail traffic may be that the 497,822 total units is an increase of more than 17,000 carloads and intermodal units over the year-to-date average of 480,595 units, and a modest 1.3% decline from this year’s previous-week total of 504,482 carloads and intermodal units.

North American totals are similarly skewed compared to the corresponding week in 2021, with the figures for 12 U.S., Canadian, and Mexican railroads up 24% overall, 29.3% for carloads, and 19.2% for intermodal traffic.

I’d be interested to see these statistics compared to, say, 2006, with coal taken out of the equation. My guess? It would show that not only has railroad traffic not paced/matched GDP growth, but it would show that the industry has shrunk.